Running a successful business means paying your bills on time. For small businesses, keeping things simple with accounts payable is a must. It’s not just about keeping vendors and suppliers happy – it’s about avoiding extra charges for late payments. If you’re always late, it could hurt your reputation, and other companies might not want to work with you. This means you could miss out on important opportunities for your business.

That’s where modern accounts payable solutions like Forwardly and QuickBooks Bill Pay come in. To help you pick the best Bill Pay solution for your business, let’s take a closer look at Forwardly and QuickBooks Bill Pay in this blog.

Spotlight: Forwardly and QuickBooks Bill Pay differences

Forwardly and QuickBooks Bill Pay are both online tools for managing accounts payable. Both platforms aim to help you pay your bills promptly, but they have distinct features that set them apart. QuickBooks Bill Pay is integrated into the QuickBooks Online interface, while Forwardly provides a user-friendly accounts payable system that can integrate with different accounting software, such as QuickBooks Online and Xero. Forwardly has a helpful dual sync feature, and its automatic reconciliation makes things easier by preventing errors.

To better understand which platform suits your small business needs, let’s get into a detailed side-by-side comparison between Forwardly and QuickBooks Bill Pay.

Forwardly’s standout features

Now, let’s explore the differences between Forwardly and QuickBooks Bill Pay even more.

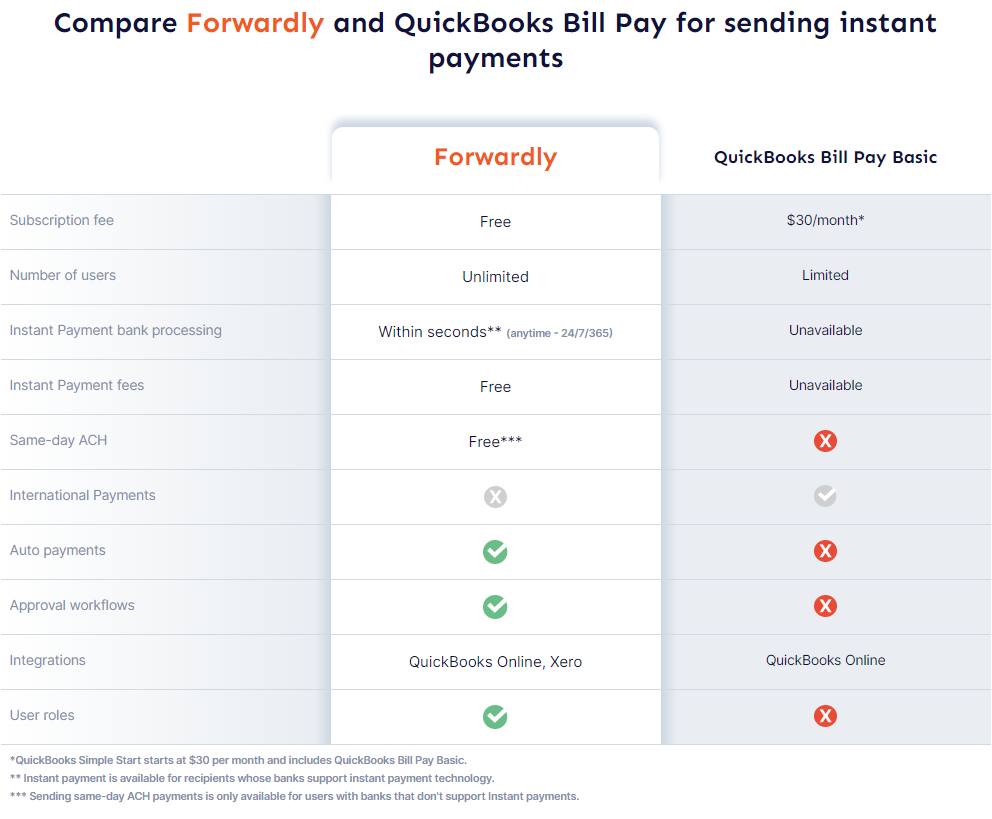

No subscription fees

Forwardly stands out by not charging any subscription fees, making the platform entirely free for users. You can send bill payments entirely for free. You only get charged minimal costs when receiving payments. There are no hidden cost surprises. This emphasizes Forwardly’s affordability and commitment to providing a cost-effective solution for managing your accounts payable.

QuickBooks Bill Pay, on the other hand, can cost between 0$ to 45$ depending on which plan you go for.

Unlimited number of users

With Forwardly, you can have as many team members as you need, manage multiple businesses, and control permissions in one dashboard—there’s no limit. In QuickBooks Bill Pay, the number of users depends on the plan. The most expensive plan ($200/month) allows up to 25 users, but the basic plan ($30/month) doesn’t support collaborators.

Cost effectiveness

When it comes to keeping your bill payments budget-friendly, Forwardly is the way to go! Sending payments won’t cost you a dime – it’s completely free. In comparison, QuickBooks Bill Pay charges Basic and Premium subscribers $0.5 per ACH-to-ACH bank transfer. Basic users get five free transfers monthly, while Premium users can send up to 40 ACH payments each month at no additional cost. Elite subscribers can send unlimited free ACH bank transfers.

Now, onto QuickBooks Payments’ Instant deposits. There’s a fee of 1.75% of the total deposit amount for instant and scheduled deposits, on top of the regular transaction processing fees. But wait, there’s a trick to save some bucks! If you link your QuickBooks debit card, that 1.75% fee is waived.

Instant payments

When it comes to instant payments, Forwardly takes the lead with its swift one-click bill payments, processing transactions in just 60 seconds for supported banks with eligible transfer limits. Whether it’s day or night, Forwardly ensures your bills are settled promptly, providing peace of mind that payments are made on time, every time. Plus, you don’t need a wallet or a specific bank account to use Forwardly, making it accessible to all.

In contrast, QuickBooks Bill Pay takes a bit longer, committing to five to seven business days for ACH transfers and 10-12 business days for standard paper checks. QuickBooks Payments offers Instant Deposits, but there are some hoops to jump through. New users might face delays, and not all transactions or financial institutions are eligible. Plus, deposits can take up to 30 minutes, except for those made between 2:15 PM PT and 3:15 PM PT, which are processed the next day.

If you opt for QuickBooks Payments’ Instant Deposits, be aware of several restrictions. You can only use Visa or Mastercard debit cards linked to your checking account, and forget about prepaid cards, ATMs, credit cards, or cash cards like PayPal. And nope, you can’t have multiple debit cards or bank accounts on file for instant deposits.

Keep these factors in mind when choosing a bill payment solution that prioritizes speedy and easy transactions for you and your vendors.

Better visibility

Forwardly allows you to set custom limits, giving you tighter control. You’ll receive instant notifications for payments sent, pending approval, or received. Plus, Forwardly offers better visibility by providing real-time updates on your bank balance before making the payment, ensuring you’re always aware of your financial status. This feature is exclusive to Forwardly, enhancing its unique value. Not just this, Forwardly facilitates swift, bank-agnostic transfers for immediate settlements and seamless reconciliation within seconds.

Auto payments

Forwardly provides small business owners with a remarkable opportunity to make a lasting impression on their clients through consistently prompt payments. By leveraging Forwardly’s auto payments feature, you can avoid the anxiety of waiting for bills to be settled, reducing the risk of late fees and lost checks, even in the eleventh hour.

It’s worth noting that QuickBooks Bill Pay lacks this particular feature in their Basic plan. While QuickBooks Bill Pay offers this feature in their Premium ($15) and Elite Plans ($90), Forwardly stands out for its commitment to simplifying the payment process for small businesses.

Payment approval workflows

With Forwardly, you get added security and control when paying bills. Whether you’re a business owner or advisor, Forwardly offers the flexibility to adapt to different types of expenses, allowing you to tailor the approval workflow process according to your needs. The ease of setting up approval settings in just a few minutes provides an added layer of control.

QuickBooks Bill Pay, on the other hand, only offers approval workflows to Elite users, limiting this feature to a specific group. Forwardly ensures that all users have access to customizable approval workflows for enhanced control.

Getting started with Forwardly

Starting with Forwardly is a smart move for small businesses looking to streamline accounts payable and manage bills effectively. From customizable approval workflows to instant bill payments, Forwardly ensures that handling your financial transactions is efficient and stress-free. With its user-friendly interface and emphasis on small business needs, Forwardly stands out as a reliable solution for effective bill management. Begin your Forwardly experience for free today, and if you’re keen on exploring our product tour, simply click here.

Back to Blog

Back to Blog