Small businesses are the backbone of our economy, driving innovation and support many local jobs. Yet, they are constantly faced with a hidden hurdle: complex invoice processing. The seemingly minor tasks of managing invoice processing can start to feel like a wrench thrown into the works. This critical process involves creating, sending, and tracking invoices, as well as ensuring timely payments from clients and customers. Unfortunately, many small businesses find themselves drowning in a sea of paperwork, unclear payment terms, and inefficient payment methods.

Efficient invoice processing might seem like a minor detail, but it plays a pivotal role in the growth trajectory of small businesses. Smooth invoices mean more time for core tasks and smart decisions. Accurate invoicing builds trust with clients and strengthens vendor relationships. These relationships are key for steady customer growth.

Understanding the common struggles

For small businesses, complex invoice processing can bring its own set of headaches. Let’s uncover the common problems that show up when dealing with complex invoices.

Heavy paperwork burden: Imagine being buried under a mountain of paperwork just to send out an invoice. That’s the reality of manual invoicing processes. From creating the invoice to printing, mailing, and filing physical copies, it’s a journey that’s far from efficient. This paperwork overload increases the chance of mistakes.

Losing or misplacing paper invoices is like losing money – late or even missed payments can happen. Plus, the manual data entry needed for this paperwork is an open invitation to errors, which isn’t great for your relationship with clients.

Sticking to traditional payment methods: For years, vendors had options like checks, regular ACH, instant ACH transfer and expensive credit cards. However, these methods are far from efficient. Cheques can take days or even weeks to process, regular ACH transfers are not much faster, and same-day ACH also doesn’t guarantee same-day transfers. Same-day ACH payments are processed quickly, but they follow bank hours. If you send one after hours, it waits until the next opening. Not to count manual errors and inaccuracies in invoices. Such delays because of slow payment options can disrupt the cash flow rhythm of small businesses.

Standalone systems: Miscommunication among sales, accounts payable, and accounts receivable can cause frustrations and delays and is a far too common issue. This happens because of separate and outdated software systems. The absence of modern solutions leads to disconnected processes and potential issues like overpayments. When your teams are stuck in their own software bubbles at different stages of invoice handling, things get messy.

Incorrect line items: Getting the details right in invoices is critical for payment processes to go smoothly. But when you’re dealing with an overwhelming amount of transactions – like products, services, how many, and at what price – things can get mixed up. Those mix-ups can lead to arguments with your clients, and those arguments might delay payments, disrupting your cash flow. This can also create difficulties when you’re trying to reconcile payments. Moreover, rectifying these discrepancies takes valuable time that could have been dedicated to more strategic tasks for your business’s growth.

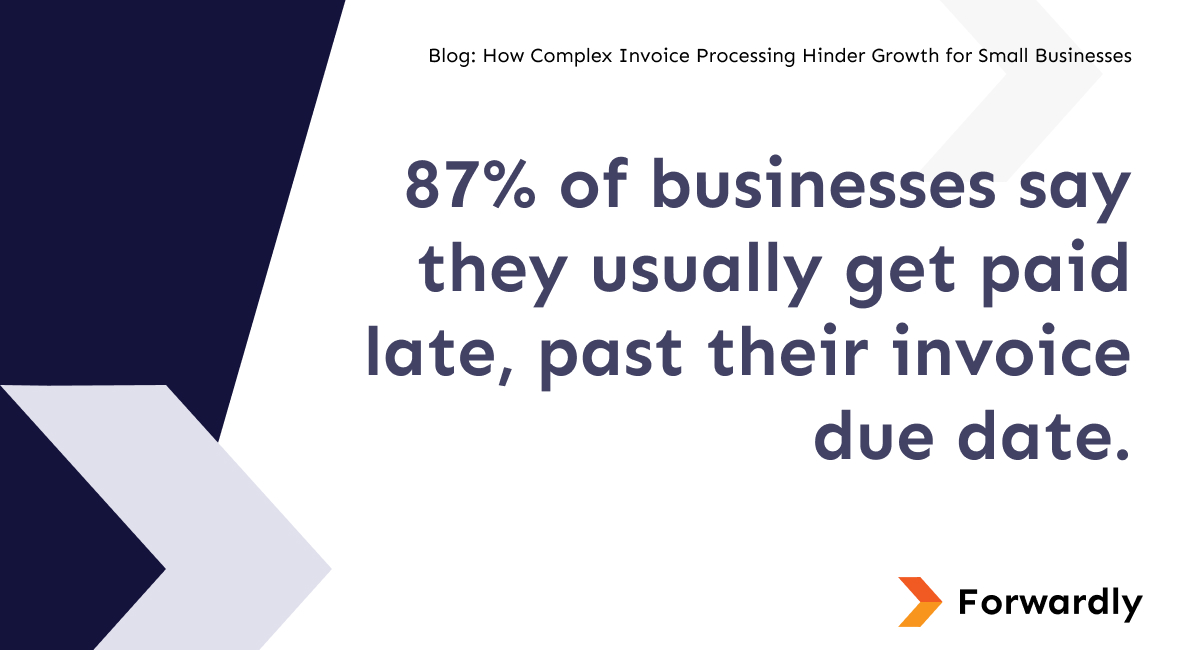

Late payments: These complications can lead to payments arriving after the due date. Delays might occur because of misunderstandings about payment terms, slow manual processing, or errors in listed items. Late payments have a domino effect, causing a ripple of negative consequences. Apart from hurting client relationships, they can cause irregular income, and avoidable extra charges, cutting into a business’s earnings. According to the 2022 late payments report, 87% of businesses say they usually get paid late, past their invoice due date. Also, when cash flow is affected, small businesses might find it tough to manage their own financial duties, like paying suppliers and staff salaries.

Diverse payment terms: Each client might come with their own set of payment terms. Some may require payment upon receipt, others within 15 days, while some might have a net 30 or even a net 60-day term. Not only a logistical challenge but also a risk for potential misunderstandings.

What are the solutions to tackle these complexities?

Modern invoice processing solution: Achieving efficiency and accuracy in financial operations is paramount in today’s fast-paced business environment. New and innovative invoice processing solution has become a powerful tool for modern businesses. B2B payment solutions like Forwardly, Ignition, and Say Anchor generate automated invoice payments. These solutions aid with minimizing errors caused by human mistakes and save time. With less manual work, business owners can concentrate on important tasks. Investing in modern solutions is a game-changer that boosts invoicing efficiency and lets your team focus on strategic tasks.

Instant payments: Instant payment solutions like Forwardly are reshaping the traditional payment landscape. It’s an all-in-one payment app, ensuring secure and seamless transactions. Forwardly stands out as the best payment processor for small businesses, offering efficient financial management. It supports The Clearing House’s RTP network and the recently launched FedNow Service from the Federal Reserve. It’s the fastest B2B payment option in the US and the most economical option, with up to 60-80% lower fees than traditional methods. Instant Payment solutions enable businesses to receive payments in less than 60 seconds, eliminating the delays often caused by traditional payment methods.

Cash flow forecasting tools: The lifeblood of any small business lies in its cash flow. Cash flow forecasting tools are important for handling financial ins and outs. Forwardly also offers a cash flow forecasting tool with up to 12 months of forecasting. By using past data and smart predictions, it guides your cash flow decisions. Businesses gain wisdom for smarter financial choices. They’re your guide to improved financial planning, ensuring enough funds for growth chances.

Start thinking Forwardly

Complex invoice processing might seem like a minor concern, but its impact on small businesses can’t be underestimated. Simplifying invoice processing isn’t just about making things easier – it’s a powerful strategy that empowers small businesses to make smarter decisions, build stronger partnerships, and save time and money.

Forwardly, with its lightning-fast payment solution and cash flow forecasting tool, presents a way forward. It’s time for small business owners to bid farewell to delays, ensure timely vendor payments, and eliminate late fees. Forwardly not only accelerates processes but also optimizes them, making the accounts payable journey efficient and hassle-free. Don’t let invoice complexities hinder your growth; take charge with Forwardly.

Back to Blog

Back to Blog