Running a small business is no cakewalk. You send out invoices, wait for payments, and hope your customers don’t treat your due date like a vague suggestion. But how long does it actually take for you to get paid? That’s where Days Sales Outstanding (DSO) comes in. DSO tells you the average number of days it takes to collect payment after making a sale. A high DSO? That means cash is stuck in unpaid invoices. A low DSO? You’re getting paid quickly and keeping cash flowing. The lower, the better.

So, how to calculate Days Sales Outstanding? Let’s break it down step by step.

What is Days Sales Outstanding and why does it matter?

DSO is real-time pulse check on your cash flow. A high DSO means customers are taking too long to pay, which can lead to:

- Cash flow problems: Nearly 82% of small businesses fail due to cash flow issues.

- Operational slowdowns: If your money is stuck in receivables, paying vendors, employees, and expenses becomes a juggling act.

- Higher risk of bad debt: The longer an invoice goes unpaid, the less likely you’ll collect it in full.

On the flip side, a low DSO means you’re getting paid quickly and consistently, keeping your business financially healthy.

How to calculate Days Sales Outstanding?

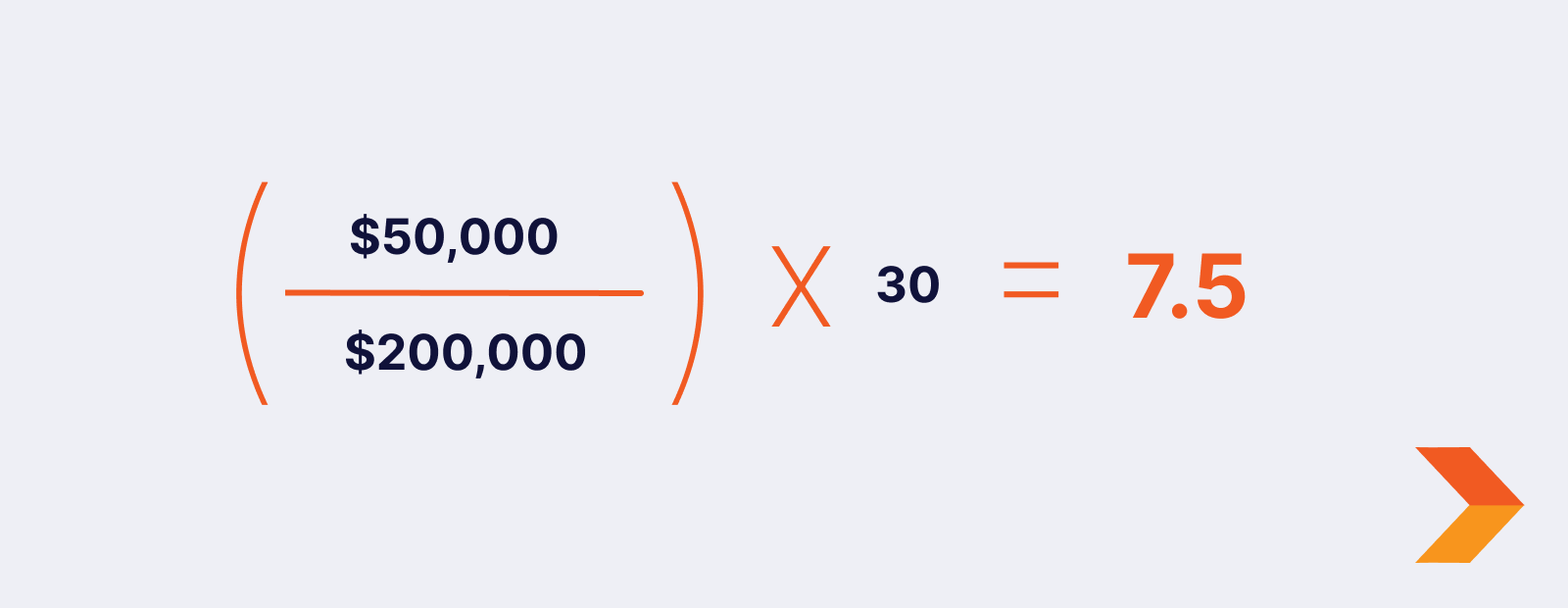

Here’s the simple formula to calculate Days Sales Outstanding:

Step-by-step breakdown

- Find your accounts receivable (A/R): This is the total amount customers owe you at a given time.

- Get your total credit sales: This includes all sales made on credit (not cash) during the same period.

- Choose your time frame: Most businesses calculate DSO on a monthly, quarterly, or yearly basis.

- Apply the formula: Plug the numbers in and calculate your DSO.

Example calculation

Let’s say:

- Your accounts receivable is $50,000

- Your total credit sales for the past month were $200,000

- The time period is 30 days

A DSO of 7.5 days means, on average, you collect payments within a week, which is great! If your DSO was 60+ days, you might have a cash flow problem brewing.

What’s a good DSO for small businesses?

A “good” DSO depends on your industry. But as a general rule:

- Under 30 days: Excellent. Your cash flow is strong.

- 30–45 days: Okay, but keep an eye on it.

- 45+ days: Time to take action. You’re waiting too long to get paid.

For perspective, the average DSO across U.S. businesses is 30 to 45 days . If your DSO is creeping up, it’s time to tighten up your collections process.

How to reduce DSO and get paid faster

If your DSO is higher than you’d like, here are practical ways to lower it:

Automate invoicing and payments

One of the biggest reasons for a high DSO is manual invoicing and slow payment collection. If you’re still chasing down invoices manually, you’re wasting valuable time and energy. Automating your accounts receivable (AR) process ensures invoices go out on time, every time, without human error. It also means follow-ups happen automatically, so you’re not constantly reminding customers to pay.

Forwardly makes this even easier with real-time payments, allowing you to get paid instantly, no processing delays, no pre-funding requirements, and no waiting days for transactions to clear.

Offer multiple payment options

Another simple but effective way to reduce DSO is to offer multiple payment options. If your customers have to jump through hoops to pay you, they’ll procrastinate. Accepting instant bank transfers, same-day ACH, and credit card payments gives them no excuse for delay. Forwardly supports all of these options, making it frictionless for customers to settle their invoices. The easier you make it, the faster they’ll pay.

Set clear payment terms

Your invoice payment terms also play a huge role in how quickly you get paid. If your invoice just says “Due upon receipt,” that’s too vague. Be clear and specific: Net 15, Net 30, or even Net 10, depending on your business needs. If your customers tend to push deadlines, consider adding late fees to encourage timely payments. A small percentage penalty on overdue invoices can be surprisingly effective at getting payments in on time.

Send reminders but politely

Even with the best terms in place, some customers will still forget. That’s where gentle reminders come in. A quick “Hey, just a reminder, your invoice is due in 3 days” email can work wonders. No one likes feeling like a debt collector, but a polite nudge often speeds up the process. Forwardly’s payment tracking features make this easy by keeping both you and your customers informed about upcoming due dates.

Incentivize early payments

Some businesses offer a 1–2% discount for early payments, which may seem like a loss at first, but when compared to the cost of chasing late payments and cash flow issues, it can be worth it. If you can afford to offer a small discount for faster payment, you might be surprised at how many customers take advantage of it.

At the end of the day, reducing DSO is about taking control of your cash flow. Want to lower your DSO and get paid faster? Forwardly’s accounts receivable services help you cut delays, avoid cash flow headaches, and keep your business moving forward. Because waiting weeks or months for payments? That’s old-school.

Get started with Forwardly for free today!

Back to Blog

Back to Blog