When it comes to managing finances, speed matters—especially for small businesses and accountants. But with so many “instant” payment solutions on the market, how do you separate the truly fast from the not-so-speedy? Payment options like “Instant ACH transfer” sound promising, but they don’t always deliver what they claim.

In this blog, we’ll break down the myths around “instant” payments, explore how traditional ACH compares to Same-Day ACH and real-time payment networks, and show you why choosing the right payment solution can make all the difference for your business.

Exploring payment solutions: what really matters

When it comes to running a small business or managing finances as an accountant, the way you handle payments can make all the difference. It’s not just about making things easy; it’s about ensuring a healthy cash flow and maintaining strong relationships with your clients.

Did you know that 7 out of 10 businesses and consumers prefer using faster payment services? Most people are inclined towards getting paid faster when given the ability. Savvy businesspeople value speed and efficiency when it comes to handling their money.

Let’s take a closer look at how payments work and understand the differences between a regular ACH and a Same-Day ACH payment.

Processing times

Regular ACH payments are like the standard option on the menu – they get the job done but at their own pace. These payments usually take 3 to 7 business days to clear. On the other hand, Same-Day ACH transactions bring in the speed factor. They can get your money moving faster, even on the same day, if requested early enough, which is a big leap in terms of efficiency. But remember, even “same day” has its limits; it’s still bound by the operational hours of banks.

Fund availability

With regular ACH, patience is a virtue. Once you initiate a payment, you’ll need to wait for the funds to be available in the recipient’s account. This wait can be a hurdle when you need to keep your cash flow steady. Instant ACH transfer improves this situation by cutting down on processing time and ensuring that funds are available sooner.

Finality of transactions

When a payment is made, both parties want assurance that the transaction is final and secure. Regular ACH payments can leave a small window for changes or reversals, causing a degree of uncertainty and worry as business owners wait to see if the payment will be processed properly- and if they’ll get paid or not. Instant ACH transfer, on the other hand, offers a more solid finality as you know the money will hit your bank faster.

The deceptive “Instant ACH” transfer illusion and the temptation of speed

Imagine a button that promises quick payments – that’s the allure of “Instant ACH.” But hold on a moment. Even though it sounds amazing, it’s not as quick as it sounds. Let’s take a closer look and find out the truth behind this.

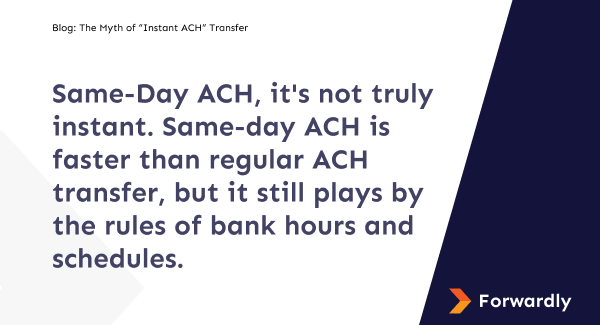

“Instant ACH” transfer gives the impression that payments happen in a snap. However, there’s a catch. Even if we’re talking about Same-Day ACH, it’s not truly instant. Same-day ACH is faster than regular ACH transfer, but it still plays by the rules of bank hours and schedules.

Same-day ACH payments are processed on the same day, which is faster than regular ACH, but they’re tied to when banks are open. If you send a payment after banking hours, it waits until the next opening. That means if you want to make business payments at night, on weekends, or holidays, you won’t be able to do it efficiently using same-day ACH.

Setting things straight

Let’s be clear: Same-Day ACH is a step towards speedier payments, but it doesn’t pass the test when it comes to true financial maneuverability. Transactions might move quicker, but they’re not immune to time limits caused by bank hours. However, there’s one more downside to consider. Instant ACH processes payments in batches. This means that accountants and business owners often don’t know exactly when a payment will happen, leaving them uncertain about when the money will be available. And when it comes to reconciliation, batching causes frustration as the data often needs to be manually reviewed.

Instant payments: A new era of business finance

In the rapidly evolving business world, instant payments are not just a catchy term – they are a reality made possible by specialized payment networks like RTP® and FedNow®. These real-time networks have changed the game by giving businesses access to funds in mere seconds, revolutionizing the way transactions happen.

The Federal Reserve’s FedNow® Service and The Clearing House’s RTP® network are the driving forces behind this revolution. FedNow® has launched with more than 57 early-adopter financial organizations certified as “Ready”, and it’s designed to offer secure and instant payment capabilities 24/7/365. RTP® has been around since 2017 and is used by multiple major banks in the USA to receive funds instantly.

Advantages of real-time transactions: A win-win situation

Why should businesses settle for delays when you can have instant results with instant payments? Real-time transactions come with a wealth of advantages that make a significant impact on your business.

Instant Cash Flow Management: Real-time transactions put you in the driver’s seat of your cash flow. No more waiting for days; your funds are available immediately. This allows for better financial planning and decision-making.

Improved Client Relationships: Swift payments build trust with your clients. They’ll appreciate the reliability of receiving funds quickly, strengthening your business relationships and fostering loyalty.

Efficient Business Operations: Real-time payments streamline your operations. With no more delays, you can allocate resources and manage projects more efficiently, optimizing your business’s overall performance.

Reduced Administrative Burden: Waiting for payments to clear often involves administrative hassle. Real-time transactions minimize paperwork, making your financial processes smoother and more automated.

Improved Cash Flow Forecasting: Predicting your future cash flow becomes more accurate with instant payments. This helps you plan for expenses, investments, and growth strategies more effectively.

Make informed choices for the future

Don’t be swayed by the allure of “Instant ACH” transfer. Choose the path of true instant payments and reap the benefits. By 2023, 90% of businesses in the US are gearing up to embrace faster payment methods. This shift isn’t just a trend; it’s a game-changer. As we embrace real-time payment solutions, the landscape of B2B payments is changing for the better.

Make the switch today

Finding the right payment solution isn’t just about keeping up—it’s about staying ahead. Real-time payment networks like RTP® and FedNow® are changing the game, giving businesses like yours the speed, reliability, and flexibility to thrive. Why settle for delays when instant payments can help you streamline operations, improve cash flow, and strengthen relationships?

With Forwardly, you get real-time payments, fewer headaches, and more time to focus on what matters most—growing your business. Say goodbye to clunky, outdated processes and hello to a faster, smarter way to pay and get paid.

Try Forwardly today and see the difference for yourself.

Back to Blog

Back to Blog